Introduction:

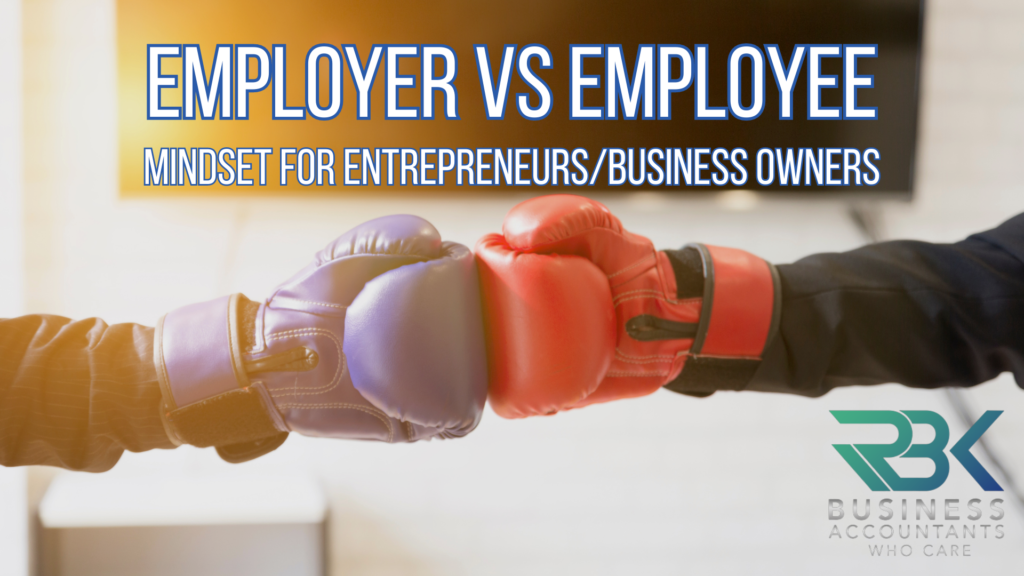

In the realm of entrepreneurship, mindset plays a pivotal role in determining the success or failure of a business venture. Many business owners, unknowingly trapped in an employee mindset, struggle to achieve prosperity and growth. This mindset, characterized by a poverty mentality and an inability to think like a true business owner, hampers their decision-making processes and prevents them from recognizing the value of essential investments.

In this blog post, we will delve into the disparities between successful business owners and unsuccessful ones, shedding light on the importance of adopting a business-oriented mindset for growth and success.

Investment in Business Growth:

Thriving business owners understand the value of investing in their ventures. They view expenditures on areas such as marketing, sales, research and development, and talent acquisition as crucial investments that drive business growth and innovation.

By contrast, business owners with a poverty mindset may hesitate to spend money on these areas, fearing financial loss and missing out on potential growth opportunities.

Perception of Accountants and Business Coaches:

Successful business owners recognize the importance of leveraging the expertise of professionals such as accountants and business coaches. They understand that these professionals offer valuable insights, strategic guidance, and help in managing finances, minimizing risks, and maximizing profitability. They perceive engaging with accountants and business coaches as investments that yield long-term benefits. In contrast, business owners with an employee mindset may view these services as unnecessary expenses or grudge purchases, failing to recognize the significant value they provide.

The Power of Business Finances: Knowing Your Numbers for Success

In addition to the mindset differences between successful and unsuccessful business owners, an essential aspect that sets them apart is their approach to business finances. Thriving business owners understand the critical role that financial management plays in driving their ventures towards prosperity. They recognize that knowing their numbers and investing in a competent finance department/section are fundamental pillars for success.

Conversely, business owners with an employee mindset tend to overlook the significance of financial expertise and view it as an unnecessary expense, hindering their path to success.

Knowing Your Numbers:

Successful business owners possess a deep understanding of their company’s financial health. They monitor key financial metrics, such as revenue, expenses, profit margins, and cash flow, on a regular basis. By staying informed about their numbers, they gain valuable insights into the financial pulse of their business and can make informed decisions that drive growth and profitability.

In contrast, business owners with an employee mindset may lack the awareness or inclination to delve into the financial details, thereby missing out on opportunities for optimization and growth.

The Importance of a Competent Finance Function:

Thriving business owners comprehend the importance of investing in a strong finance function/department. They recognize that having a team of experienced professionals, including skilled accountants, financial analysts, and bookkeepers, is instrumental in managing finances effectively. These experts provide critical support in areas such as financial planning, budgeting, forecasting, tax compliance, and risk management. By valuing and investing in their finance function, successful business owners ensure the accuracy, integrity, and strategic utilization of financial information.

Avoiding Cheap and Inexperienced Finance Staff:

Business owners with an employer mindset understand that cutting corners when it comes to their finance function can have detrimental consequences. They recognize that employing cheap and inexperienced finance staff may lead to errors, compliance issues, and missed opportunities for financial optimization. Instead, successful business owners prioritize hiring skilled professionals who bring expertise, efficiency, and a strategic mindset to their finance department. By doing so, they establish a strong foundation for financial management and gain a competitive edge in the market.

Leveraging Financial Insights for Growth:

Successful business owners harness the power of financial insights to drive business growth. They utilize financial data to identify trends, evaluate performance, and make data-driven decisions. By having a clear understanding of their numbers, they can identify areas of improvement, allocate resources strategically, and seize opportunities for expansion. This proactive approach enables them to stay ahead of the competition and capitalize on market trends.

Conclusion:

In the dynamic world of entrepreneurship, the difference between success and failure often lies in the mindset of the business owner. Embracing a comprehensive understanding of business finances is a hallmark of successful business owners. By prioritizing the importance of knowing their numbers and investing in a competent finance function/department, they position themselves for sustainable growth and profitability. Recognizing that financial expertise is not an expense but an invaluable asset, these business owners set themselves apart from their counterparts trapped in an employee mindset. Aspiring entrepreneurs should embrace the power of financial management and surround themselves with a skilled finance team to unlock the full potential of their businesses.

Those who embrace the mindset of an employer, with a focus on long-term vision, calculated risk-taking, and strategic investments, are more likely to prosper. Recognizing the value of professional services, such as accountants and business coaches, is a crucial element of this mindset shift. By adopting the mindset of a successful business owner, aspiring entrepreneurs can pave their way to growth, prosperity, and ultimately, long-term success.